About ARES Index

AJPI・AJFI products were expanded with their going into full operation

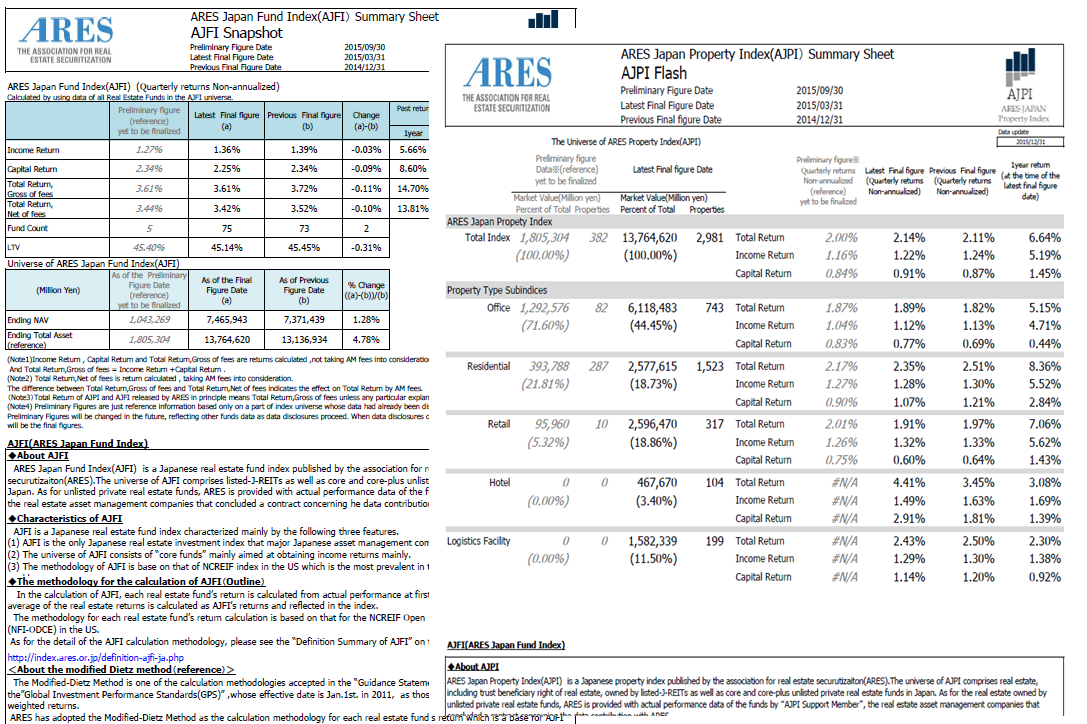

In February 2016, ARES started to publish new products of AJPI and AJFI, consisting of new subindices and AJPI・AJFI summary sheet. The new subindices include AJFI-Open End Core Unlisted REITs (AJFI-OURs), AJPI-Hotel and AJPI-Logistics Facilities, etc.

In October 2012, ARES started experimental provision of Japan's new real estate indices, the ARES Japan Property Index ("AJPI") and the ARES Japan Fund Index ("AJFI") whose universe comprises not only listed J-REITs but also unlisted core real estate funds.

After the period of experimental provision of AJPI and AJFI, ARES started full-scale operation of AJPI and AJFI in February 2016.

AJPI, which is constructed based on the NCREIF's index methodology, covers core real estate investment market more widely, and is expected to be widely used by global and domestic investors as a Japan's major property index.

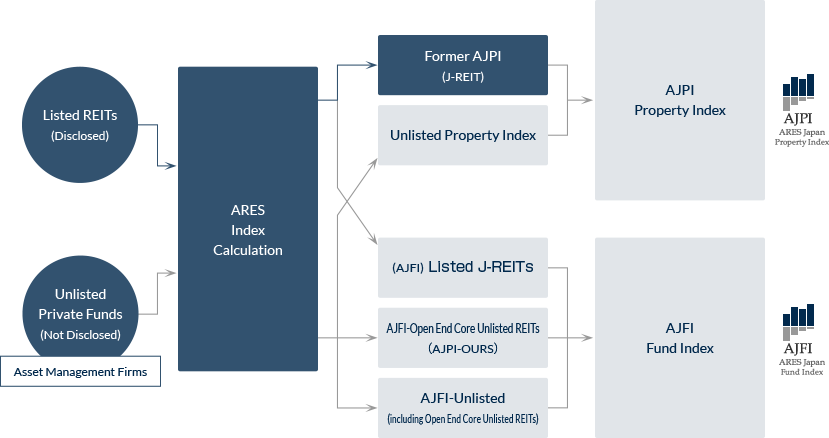

The classification of AJPI・AJFI by universe and indices

About the Characteristics and uses of AJPI & AJPI

ARES initially treated the calculation and release of AJPI and AJFI as experimental. During the experimental stage, the activities for the increase in the number of data contributors, the detailed investigation and the enhancement of the calculation logic, and discussions about the possibility of additional services and products, were conducted.

Now ARES starts the full-scale operation of AJPI and AJFI because the number of data contributors reached over 20 and the detailed inspection and enhancement of the calculation logic.

The new out puts after starting full-scale operation

With the turning point of starting full-scale operation of AJPI and AJFI, some new sub-indices and data formats showing the summary of the latest data are added to AJPI and AJFI outputs. The new out puts are as follows.

The newly released sub-indices

AJFI subindices

- AJFI-Open End Core Unlisted REITs(AJFI-OURs)

The index is the equivalent of the NFI-ODCE in the US2 - Subindices categorized by LTV( Low LTV, Middle LTV, and High LTV )

- Net returns of each index of AJFI as well as gross returns

AJPI subindices

- AJPI-hotel and AJPI-Logistic facilities

- AJPI-Retail(Urban) and AJPI-Retail(Suburban)

They are subindices of AJPI-Retail - AJPI-Tokyo Metropolitan Area

The Tokyo Metropolitan Area includes Tokyo, Kanagawa, Saitama and Chiba

AJPI・AJFI Summary Sheet ; the standard format of the latest data (English and Japanese)

It is expected that AJPI and AJFI are recognized as Japan's standardized indices and they are wildly used by not only Japanese investors but also foreign investors.