AJPI Outline

ARES Japan Property Index

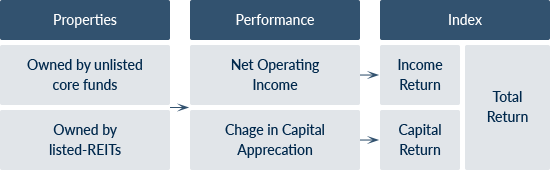

ARES Japan Property Index ("AJPI") is the index calculated from the universe of income-producing properties owned by core real estate funds mainly for institutional investors. Property index is a weighted-average index calculated by actual NOI data from operating activities and capital appreciation data based on changes in the external appraisal value.

Conceptual diagram of AJPI

- Note) Capital appreciation = The end of market value - The beginning of market value

AJPI is the performance index calculated from weighted average income returns and capital returns which are provided from unlisted private funds' data (undisclosed) and listed REITs' data (disclosed).

Inclusion of listed REITs' data

J-REITs, Japanese Real Estate Investment Trusts, can be classified as "plain core fund" and included in the AJFI, as they are different from REITs in other countries with the following three points;

- J-REITs' activities are regulatory restricted to be rental businesses for the long-term investment

- J-REITs disclose actual NOI and external appraisal value by property twice a year

- J-REITs' loan to value ratio generally remains low.

AJPI Fact Sheet

- Name

-

ARES Japan Property Index

- Outline

-

Performance index for income-producing properties owned by core real estate funds for institutional investors

- Index data

-

- Monthly index (1000 points at December 31, 2001)

- Quarterly and annual returns

- Sub-index by type or area

- Universe profile: number of properties, total assets, average occupancy, and cap rate

- Methodology

-

- Weighted-average index of income returns (Net Operating Income) and capital appreciation returns (changes in appraisal value)

- Income return + Capital Appreciation return = Total return

- Conforming the methodology of NCREIF Property Index (NPI) in the United States

- Information

-

- Monthly update

- ARES website: AJPI Databook (Free download spreadsheets)

- Vendors : Bloomberg

- Universe

-

- Properties owned by unlisted core funds and all of properties owned by J-REITs. Performance data from unlisted core funds is provided from AJPI Support Members

- ARES hope to cover core investment market more widely, where institutional real estate is traded, and plan to expand the AJPI's universe step by step.