Examples of the use of

AJPI & AJFI

Example 4The use for real estate risk management

Classification of real estate-related risks

Among real estate-related risks are those displayed on the following diagram. The perception, assessment and response for the real estate-related risks can be issues in real estate investments.

| Risk classification | |||

|---|---|---|---|

| Real estate-related risks | Physical risk | Disaster risk | Earth quake risk |

| Wind and flood damage risk | |||

| Accident risk | |||

| Environmental risk | Soil pollution risk | ||

| Asbestos risk | |||

| Archaeological risk | |||

| Surrounding environment risk | |||

| Legal risk | Legal compliance risk | ||

| Regulatory risk | |||

| Administrative operation risk | |||

| Market risk | Real estate market fluctuation risk | ||

| Credit risk | |||

| Interest rate risk | |||

| Liquidity risk | |||

- Ministry of Land, Infrastructure, Transport and Tourism

Use for ontrolling the real estate market fluctuation risk

Real estate indices indicate the average trend of the real estate market. So, the indices are expected to be utilized in controlling the real estate market fluctuation risk among those risks mentioned above as the market risk, (i.e. the risk related to overall market that cannot be dealt with by diversified investment)

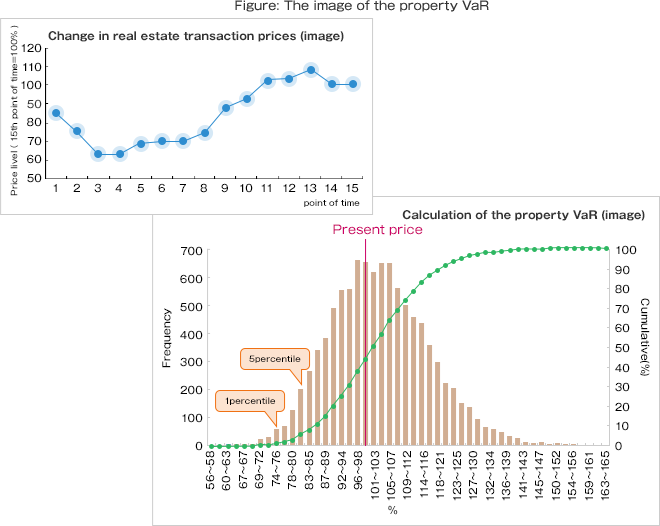

A possible example for the evaluation methodology of real estate market fluctuation:Property VaR(Value at Risk)

The Property VaR, in which the general ideas Value at Risk utilized in the risk management of financial instruments, has been proposed as a methodology for the evaluation of real estate market fluctuation. However, it was pointed out that the possibility to utilize the Property VaR was limited due to the lack of established real estate indices in the past. As for the outlines of the Property VaR, please refer to the figure below.

- The above-described figure is an image not based on actual real estate information but based on assumed data. VaR usually means the possible maximum loss which occurs with a certain probability such as 1% or 5% confidence level. However it is shown here as price level(%) here because assumed data are utilized.

- Ministry of Land, Infrastructure, Transport and Tourism

Expectations for promoting improvement of environments in which effective real estate risk management is easy to carry out.

It is expected that environmental improvement will realize in which effective real estate risk management is easy to carry out as real estate investment indices such as ARES Japan Property Index(AJPI) are enriched in their universe coverage or length in the period of data