Examples of the use of

AJPI & AJFI

Example 3The use in the process of Real Estate Investment by institutional investors

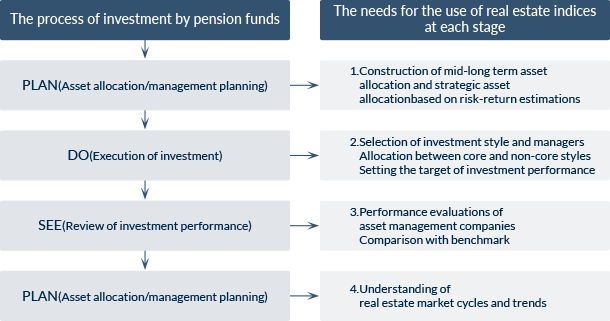

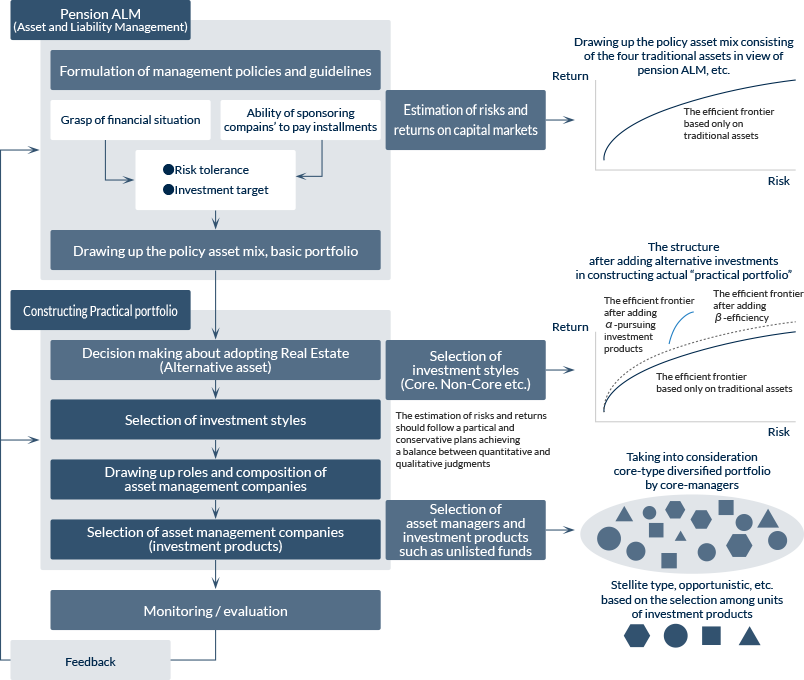

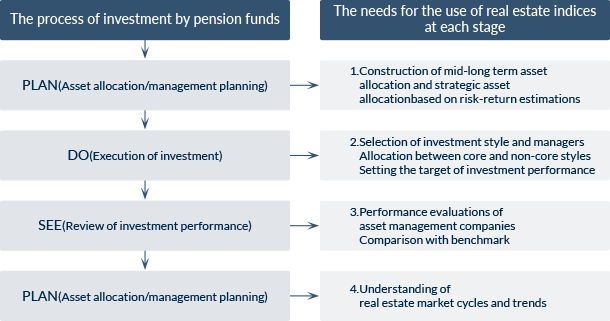

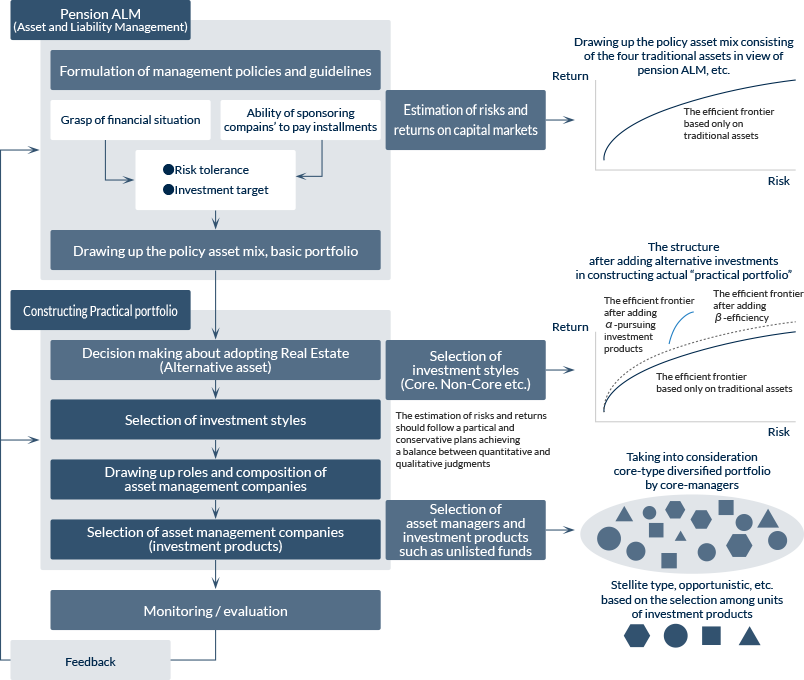

The use in each process of the PLAN→Do→SEE→PLAN Cycle

- PLAN

- SAA (Strategic Asset Allocation) Allocation funds to real estate

-

In the process of planning

- What should the allocation to real estate be?

- Drawing up the policy asset mix (basic portfolio) medium- to long-term asset allocation, Domestic bonds XX%, domestic stocks XX%, International bonds XX%, International stocks XX%

- Measuring quantitative risks - in the use of Property Index(AJPI etc. …)

- Allocating tolerable quantitative risks to each asset.

- DO

- Selection of investment targets and investment managers Measuring of portfolio risk

-

In the Process of Investment Execution

- Under the allocation constraint mentioned above, what investment targets and investment targets should be selected

- Which is the degree of diversification and risk in overall investment portfolio?

- Measuring quantitative risk in the use of Real Estate Fund Index(AJFI etc. )

- SEE

- Verification of investment performance Attribution analysis

-

In the Process of Investment review

- Investment management and verification of performance after investment

- Attribution analysis of the market - in the use of Property Index(AJPI etc. )

- Attribution analysis of each fund’s performance - in the use of Real Estate Fund Index(AJFI ,etc. )

The use of real estate investment in the process of investment management by pension funds

The needs for real estate investment indices in the process of investment by pension funds