AJFI Outline

ARES Japan Fund Index

ARES Japan Fund Index ("AJFI") is the index calculated from the universe of core funds' performance. These funds generally borrow some external debt for leverage effect, so this kind of fund index is also called "Leveraged Property Index.

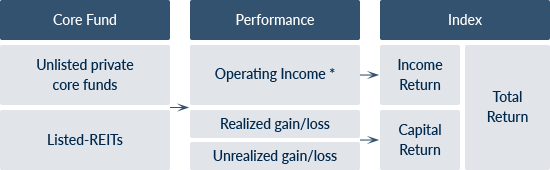

Conceptual diagram of AJFI

- Unrealized gain/loss = Change in NAVs

NAV = Total assets - Total liabilities = invested Capital + capital appreciation

Capital appreciation = Market value (External appraisal value) - Bookvalue

AJFI is the performance index calculated from weighted average income returns and capital returns which are provided from unlisted private funds' data (undisclosed) and listed REITs' data (disclosed).

- Operating Income here equals net profit minus (profits and losses from investment transactions)

Inclusion of listed REITs' data

As J-REITs, Japanese Real Estate Investment Trust, are different from REITs in other countries with the following three points, they can be classified as "plain core fund" and included in the AJFI.

- J-REITs' activities are regulatory restricted to be rental business for the long-term investment

- Disclosing external appraisal value by property twice per year

- Disclosing operating data such as NOI and Sales proceeds by property

J-REITs' equity, as you know, is listed and traded in the market, but AJFI includes non-traded NAV changes of J-REITs' equity by reckoning listed J-REITs as non-traded private funds.

On the other hand, the open-ended core funds are included in the composite of unlisted private funds, and they are similar to J-REITs in terms of "the leverage level" and "plane core strategy".

AJFI Fact Sheet

- Name

-

ARES Japan Fund Index

- Outline

-

Performance index for core private real estate funds

(leveraged property index)

- Index data

-

- Monthly index (1000 points at December 31, 2001)

- Quarterly and annual returns

- Universe profile: number of funds, total assets, NAVs, etc

- Sub-Indices (AJFI-Open End Core Unlisted REITs etc.)

- Methodology

-

- Weighted-average index of income returns (net income before management fees) and capital returns (changes in NAV appreciation on an appraisal basis)

- Income return + Capital Appreciation return = Total return

- A time-weighted return with modified Dietz method

- Conforming the methodology of NCREIF Fund Index (NFI) in the United States

- Information

-

- Monthly update

- ARES website: AJFI Databook (Free downloadable spreadsheets)

- Vendors : Bloomberg etc.

- Universe

-

- Core or Core-plus strategy; unlisted private funds, open-ended private funds, and J-REITs

- AJFI includes non-traded NAV changes of J-REIT equity by reckoning listed J-REITs as non-traded private funds.