Examples of the use of

AJPI & AJFI

Example 2The use for the comparison with other assets

By utilizing the ARES’s Real Estate Investment Indices, ”AJPI and AJFI”

|

2011 |

| 2010Y |

Q1 |

Q2 |

Q3 |

Q4 |

2011Y |

| Main indices |

|

| Domestic stocks |

TOPIX Total Return |

0.96% |

-2.18% |

-2.22% |

-9.44% |

-4.17% |

-17.00% |

| Domestic bonds |

NOMURA-BPI |

2.20% |

-0.78% |

1.04% |

1.03% |

0.37% |

1.65% |

| Foreign stocks |

MSCI KOKUSAI |

11.87% |

4.41% |

-0.23% |

-15.12% |

9.27% |

-3.39% |

| Foreign bonds |

CITIGROUP WGBI |

3.36% |

-0.65% |

1.67% |

3.99% |

0.68% |

5.74% |

| Exchange rate |

JPY/USD |

-11.97% |

1.91% |

-2.93% |

-4.48% |

0.68% |

-4.87% |

| Real Estate |

|

| J-REIT |

Tokyo Stock Exchange REIT Index Total Return |

34.12% |

-5.45% |

-1.45% |

-8.43% |

-8.79% |

-22.18% |

| Real Property |

AJPI※ |

-4.37% |

0.73% |

0.99% |

0.99% |

0.97% |

3.74% |

| Unlisted real estate fund |

AJFI※ |

-1.91% |

0.80% |

1.32% |

1.57% |

1.62% |

5.42% |

|

2012 |

| 2010Y |

Q1 |

Q2 |

Q3 |

Q4 |

2012YTD |

| Main indices |

|

| Domestic stocks |

TOPIX Total Return |

0.96% |

18.55% |

-9.74% |

|

|

7.01% |

| Domestic bonds |

NOMURA-BPI |

2.20% |

0.32% |

0.96% |

|

|

1.28% |

| Foreign stocks |

MSCI KOKUSAI |

11.87% |

10.60% |

-3.43% |

|

|

6.81% |

| Foreign bonds |

CITIGROUP WGBI |

3.36% |

0.57% |

1.59% |

|

|

2.17% |

| Exchange rate |

JPY/USD |

-11.97% |

6.10% |

-3.16% |

|

|

2.75% |

| Real Estate |

|

| J-REIT |

Tokyo Stock Exchange REIT Index Total Return |

34.12% |

20.31% |

-1.91% |

|

|

18.01% |

| Real Property |

AJPI※ |

-4.37% |

0.97% |

0.98% |

|

|

1.96% |

| Unlisted real estate fund |

AJFI※ |

-1.91% |

1.70% |

1.78% |

|

|

3.51% |

- Bloomberg

- ARES Japan Property Index (AJPI): Real Property Index / ARES Japan Fund Index (AJFI):Unlisted Real estate fund index / The data on 2012Q1 and Q2 are preliminary figures

- We can easily compare the return of Real Estate with that of other assets.

- We can get objective data necessary for the quantitative analysis of the average return levels, return volatilities and return correlations among assets, etc.

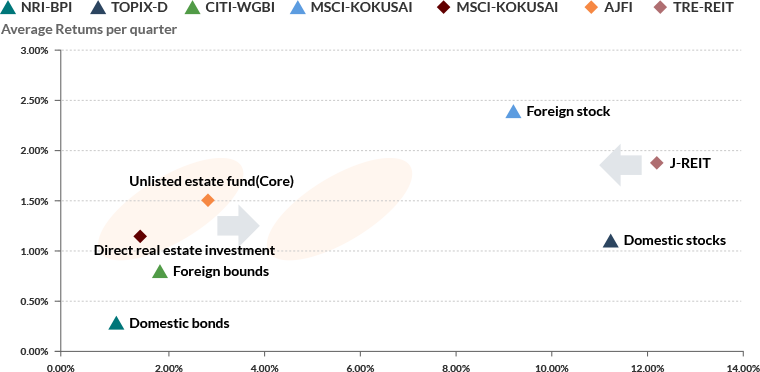

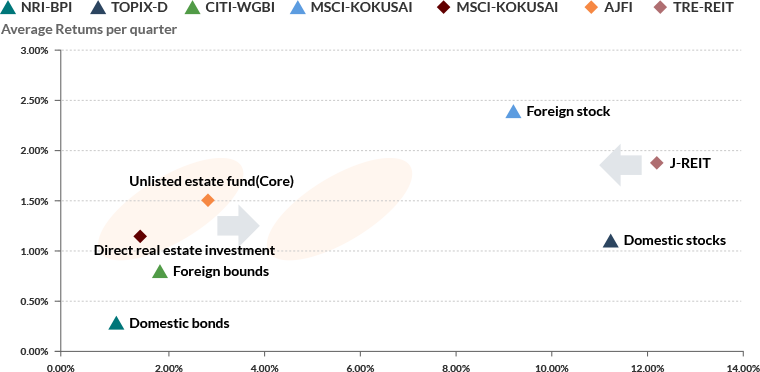

Characteristic of risk and return on each asset

- We can easily understand the risk -return characteristic of assets and compare it with other assets

- However, the periods for analysis etc. should be properly set in line with utilization purposes

- It is widely known that Real Estate Investment Indices have a tendency to show lower volatilities, “the smoothing effect”. This is not a phenomenon peculiar to the AJPI and AJFI but common among Real Estate Investment Indices worldwide

- Therefore, certain modifications may be made if required