Characteristics of

ARES Real Estate Investment Indices

(AJPI & AJFI)

Characteristic 1Real Estate Investment Indices based on the actual performance data of Japanese funds and their own Real Estate Performances respectively under the operations of Japanese major Real Estate asset management companies.

ARES’s Real Estate indices, AJPI & AJFI, emerged as Japanese indices equivalent to those based on actual performances that have been prevalent and widely used for a long time in the United States and some European countries.

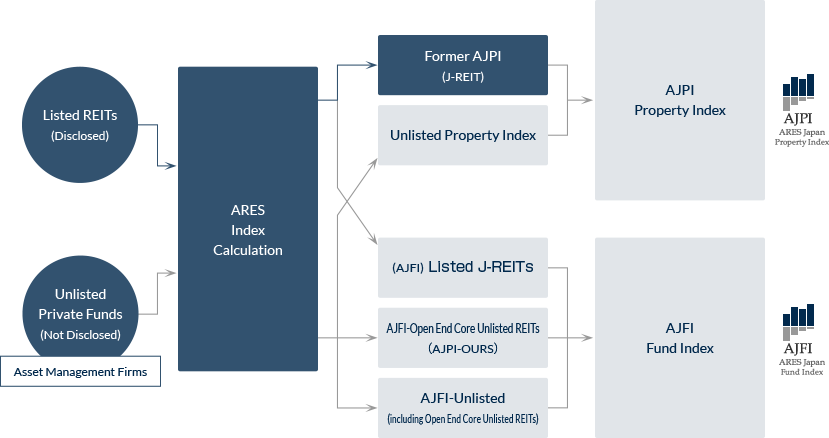

The Real Estate Investment Indices released by ARES comprise (1)the ARES Japan Property Index ”AJPI” and (2)the ARES Japan Fund Index ”AJFI”.

- AJPI is the Japanese property index reflecting the weighted average of returns on Real Properties.

- AJFI is the Japanese Real Estate Fund index reflecting the weighted average of returns on Real Estate funds.

AJPI&AJFI are characterized in that both of them are calculated not based on any estimation but on actual performance data.

In the Real Estate Investment Market with a long history, such as the United States and some European countries, Real Estate Investment indices play significant roles as an infrastructure. However, in Japan, such kinds of real estate investment indices could not be produced because performances on real estate management we were not usually disclosed to a third party. Many traditional Japanese real estate indices were calculated by utilizing limited actual performance data or publicly released statistics with certain estimations or assumptions.

However, as for the J-REITs whose first listings occurred in September 2001, the public disclosures of their performance data were made, not only for their fund but for their own property. Many major Japanese real estate asset management companies agreed with ARES to contribute their performance data, enabling ARES to calculate ARES’s Japanese Real Estate Investment Indices, AJPI&AJFI, based on actual performances not only on listed J-REIT, but also on unlisted Real Estate funds under the management of major Japanese real estate management companies.

Characteristic 2Real Estate Indices covering Japanese “Core Real Estate Funds”

ARES’s Real Estate indices, AJPI & AJFI, cover not only overall J-REITs but also unlisted Japanese Real Estate funds that are classified as “Core Fund” in view of their investment strategies mainly to acquire income returns .

Real Estate Funds have various investment strategies especially among unlisted-non public offering funds that are often classified as “Core”, “Core-Plus”,” Value-Added”, and “Opportunistic” depending on their investment strategies. Both of ARES’s AJPI&AJFI are the Japanese real estate investment indices whose universe comprises “Core” and “Core-Plus” of Japanese real estate funds mainly to acquire income returns .

ARES calculates AJPI&AJFI by gathering performance data on unlisted Real Estate Funds securing the confidentiality of the data as well as by utilizing J-REITs’ performance data publicly disclosed.

Characteristic 3The only real estate indices in Japan participated in by Japanese major real estate asset management companies

ARES’s Real Estate indices, AJPI & AJFI, are the only Japanese Real Estate Investment Indices in that many Japanese major Real Estate asset management companies cooperate in the data contribution. As for listed J-REIT data, publicly disclosed data are gathered and included.

Generally, data on unlisted-non public offering funds are highly-confidential, so such data are not disclosed to a third party in principle. However, Real Estate Investment indices, which are aggregated figures comprising performance data on unlisted-non public offering fund, as one of the market infrastructures, in major overseas markets in the United States and Europe. With this point in mind, the expectations gradually mounted in Japan for facilitating Real Estate Investment Indices. Then ARES started developing its own Real Estate Investment Indices after several years of discussions in the ARES’s subcommittee on Real Estate Investment for Pension Funds.

Finally, the framework for the calculation of AJPI&AJFI has materialized by concluding contracts with major Japanese asset management companies for the contribution of unlisted funds’ performance as well as by preparing a system of platform to prevent data leakage.

- Related Links

Characteristic 4Real Estate investment Indices in Japan complying in calculation methodology with NCREIF’s Indices in the United States

ARES's Real Estate indices, AJPI & AJFI, are the Japanese Real Estate investment Indices complying in calculation methodology with NCREIF's Indices that are the most prevalent in the United States and most of the world.

The calculation methodologies of AJPI & AJFI are complying with those of National Council of Real Estate Investment Fiduciaries, “NCREIF” which is a non-profit organization founded in the United States in 1982.

NCREIF's Real Estate Investment Indices with a long history have got recognition as one of the very important infrastructures and their indices are widely used by market participants.

It is expected that ARES's Real Estate Investment indices, AJPI & AJFI, will be easily accepted and will be recognized as Japan’s standard Real Estate Investment Indices in the same way as NCREIF in the United States by complying with NCREIF’s methodologies familiar to world participants in the calculation of AJPI & AJFI.

- Related Links